A GRC (Governance, Risk & Compliance) system is a comprehensive tool that integrates governance, risk management, and regulatory compliance processes into a single platform.

It unifies policies, controls, and reporting by eliminating organizational silos, automating workflows, and providing centralized visibility into a company’s risks and compliance obligations.

This type of software is based precisely on the GRC methodology. With this integrated management model, it is possible to make more informed decisions, protect assets, and ensure that a company’s operation meets legal requirements and internal policies.

Get to know the eight main options on the market and see which one is the most advantageous for your company. Also, understand more about this methodology and how a GRC tool can help your company mitigate risks and strengthen itself against vulnerabilities.

What is the GRC methodology?

The GRC methodology emerged in the early 21st century to help companies integrate and coordinate governance, risk management, and compliance — thereby improving efficiency and performance.

The OCEG (Organization for the Advancement of Corporate Governance) was instrumental not only in creating this concept but also in helping to popularize it in companies. Soon, it became a model for integrating these areas.

The methodology provides a structured basis for corporations of diverse sizes and sectors to manage their governance policies, assess and mitigate risks, and comply with regulatory requirements holistically. In this way, GRC promotes agility, transparency, and security.

Key components of the GRC methodology

Governance

- Establishment of policies, standards and authority roles within the company;

- Definition of responsibility for boards and executives of the organization.

Risk Management

- Mapping and analysis of risks (financial, operational, IT, among others);

- Implementation of controls and incident response plans.

Compliance

- Continuous monitoring of standards (LGPD, SOX, ISO, etc.) and legislation;

- Visualization of automated reports for auditing (internal and/or regulatory bodies).

What is the GRC system?

A GRC system is the platform that integrates governance, risk management, and regulatory compliance processes into a single environment. It unifies policies, controls, reports, workflows, and more.

In other words, GRC software is how organizations implement the GRC methodology. With it, you can:

- Centralize corporate governance policies and procedures;

- Map and monitor risks;

- Automate compliance and internal audit processes;

- Generate consolidated reports for shareholders and regulatory bodies.

Main features of GRC

Governance Management

- Definition of policies, roles and responsibilities of those involved with the use and control of GRC;

- Creation of approval flows and recording of decisions that provide the necessary traceability in audits.

Risk Management

- Identification and classification of risks (both those that have already occurred and possible risks);

- Quantitative and qualitative analysis of the risks pointed out, pointing out the probability of occurrence versus the impact it would cause on the operation;

- Mitigation plans and monitoring of corrective and preventive actions.

Compliance Management

- Cataloguing of standards and regulations relevant to the company;

- Continuous monitoring of compliance controls and indicators;

- Automatic generation of evidence for internal and external audits.

12 Benefits of Using a GRC System

As a tool based on an integrated approach, the main advantage of using a GRC system is to align all processes related to business goals, risks, and legal requirements in a single solution.

As a result, decisions become better informed and emergencies are dealt with proactively, preventively and with continuous improvements. Thus, a company has strategic, operational, regulatory, and cultural gains.

Strategic benefits

At a strategic level, a GRC provides a holistic view of the company’s risks and compliance, supporting decision-making with up-to-date and reliable data.

It eliminates internal silos, aligning IT, compliance, quality, and business objectives. In addition, this solution strengthens corporate governance, increasing transparency and trust from investors, customers, employees, and other stakeholders.

- Better decisions: GRC consolidates risk and compliance reports and metrics, allowing strategic decisions based on valuable information.

- Unified view: The platform centralizes audit data, controls, and performance indicators, facilitating access to this data and avoiding fragmentation between sectors.

- Reputation and trust: GRC software reinforces the culture of responsibility, quality, and compliance, making the company more well-recognized in the market.

Operational benefits

At the operational level, GRC ensures that the company’s critical processes comply with the relevant standards and policies. In addition, when this tool is used in complete solutions, which also have process and workflow management functionalities (as in the case of SoftExpert Suite), it is possible to automate these critical processes.

In this way, they can focus on strategic risk analysis. A GRC system brings operational efficiency with clear internal controls, process traceability, data centralization, and noise prevention.

- Cost reduction: Process automation and centralized compliance management reduce operational costs and the likelihood of penalties.

- Increased productivity: The GRC solution eliminates redundant manual tasks and increases the scalability of critical processes, increasing the efficiency of audit and quality control teams.

- Full control of compliance management: With a single repository of risks and controls, a company gains greater visibility, clear and structured internal controls, traceability of critical processes aligned with business objectives and regulations, centralization of information, greater corporate governance, risk prevention, and increased security.

Regulatory and compliance benefits

GRC systems assist in ongoing compliance with internal and external regulations, and provide detailed audit trails, which simplify compliance inspections and assessments. With this, the organization reduces the risks of non-compliance and its consequences (such as fines, sanctions, litigation, among others).

GRC also strengthens information security and privacy. This solution has built-in controls that protect companies from data breaches and help comply with data protection laws (such as GDPR).

- Automated compliance: Constant verification of standards and policies ensures that internal processes are aligned with legal requirements, thus generating evidence for audits and, consequently, increasing the chances of success and reducing the incidence of non-compliance.

- Fewer penalties: By preventing regulatory violations and documenting evidence, the company minimizes the chances of incurring fines and legal costs related to non-compliance.

- Information security: Unified IT policies and controls make the company more resilient to digital threats, thus preserving the confidentiality and integrity of the sensitive data it may store.

Cultural benefits

The adoption of a GRC system strengthens the organizational culture of ethics and compliance. Common standards and processes are established, so that all members of a corporation understand the rules and responsibilities involved.

This transparency promotes greater accountability at all levels, since failure to follow controls generates previously defined consequences. In addition, transparency about internal and regulatory risks engages teams.

As a result, employees start to adopt preventive practices daily and report problems openly. Thus, the company gains in internal and external credibility, having a more ethical and proactive environment in quality control.

- Clearer governance: GRC software standardizes decision-making, validation, and who’s responsible for what, improving corporate accountability and task traceability.

- Transparency and ethics: Accessible reporting and shared communication reinforce trust within the organization, which, with this maturity, is more successful in adopting ethical practices that hinder fraud and embezzlement.

- Team engagement: Unified training and policies inspire employees to take responsibility for compliance, creating a culture of conscious risk across the company.

How to choose GRC software: the essential features

Choosing an effective GRC system is a strategic decision that must consider the specific needs of the organization, its size, sector of operation, and level of maturity in this regard.

To help you make this decision in an informed and efficient way, we have listed the essential features that good GRC software should offer, as well as practical criteria for making this decision.

7 essential features of a GRC tool

1. Integrated risk management

- Registration and risk assessment (probability, impact, category);

- Risk matrix and mitigation plans;

- Automatic alerts and notifications on emerging risks;

- Event traceability and treatment history.

2. Compliance management

- Repository of standards, policies and regulations;

- Compliance assessments and internal control tests;

- Generation of evidence for audits (internal and/or external).

3. Corporate governance

- Mapping of organizational structures, with roles and responsibilities;

- Management of policies and codes of conduct;

- Workflows for approvals, decision-making and document management;

- Governance reports.

4. Automation of controls and auditing

- Definition and monitoring of internal controls;

- Scheduling and execution of audits;

- Action and remediation plans with those responsible, details and deadlines;

- Dashboards and audit reports with real-time information;

- Ability to automate processes and workflows and create alerts.

5. Incident management and operational compliance

- Recording and handling incidents (fraud, failures and non-conformities);

- Integration with reporting channels;

- Performance and compliance indicators;

- Response and business continuity plans.

6. Reporting and business intelligence

- Customizable dashboards with GRC KPIs;

- Automatic reports to audits, councils and regulators;

- Export in various formats (PDF, Excel, APIs, among others);

- Predictive analytics.

7. Integrations and scalability

- Integration with external regulatory bodies, ERPs, financial systems, HR, information security, among others.

- Scalability to multiple business units or countries.

Criteria for choosing a GRC

- Adherence to the company’s needs: Evaluate whether the software covers the main processes in your area (regulatory compliance, operational risks, information security, among other demands).

- Ease of use: Analyze if the interface is intuitive, with a short learning curve for non-technical users.

- Customization and flexibility: Find out if the tool allows you to configure fields, reports, flows, and permissions according to the needs of your business. It is essential to understand if the solution can adapt to the growth of your organization.

- Total cost of ownership (TCO): Consider not only the price of the license itself, but also any support, implementation, and maintenance costs.

- Technical support and consulting: Check if the supplier company has dedicated support, a well-defined SLA, and experience with other customers in your industry.

- Reputation and success stories: Research whether major players or competitors use the platform.

What are the 8 best Governance, Risk and Compliance tools?

When investigating and researching the various GRC software solutions available on the market, you should evaluate skills, user experience, and opinions of those who already use each platform.

Thus, you identify which option best meets the demands of your business – always considering the aspects already presented throughout this post.

To make this choice simpler, we have prepared a comparison of the eight main GRC tools available: SoftExpert GRC, Vanta, Diligent, MetricStream, LogicGate, Riskonnect, Workiva and Archer IRM.

Below, check out a summarized table of these solutions and an in-depth analysis of each one.

| Software | Capterra | G2 | Top Features | Key Pros | Key Cons |

| SoftExpert Suite | 4.6 | 4.7 | Scalable GRC platform, cloud operation and risk-linked process automation. | automation of critical processes; scalable modules and good support. | Long onboarding; Limited integrations. |

| Advantage | 4.5 | 4.6 | Cloud operation; guided remediation. | Quick setup; Good support. | Focus on IT; expensive customizations. |

| Diligent (formerly known as Galvanize) | 4.5 | 4.3 | Continuous audit; Analytics. | Robust analytics; Ideal for internal auditing. | polluted UX; high cost. |

| MetricStream | 3.9 | N/A | Full GRC suite; business continuity management. | Scalable to large; Specialized modules | Long implementation; High cost |

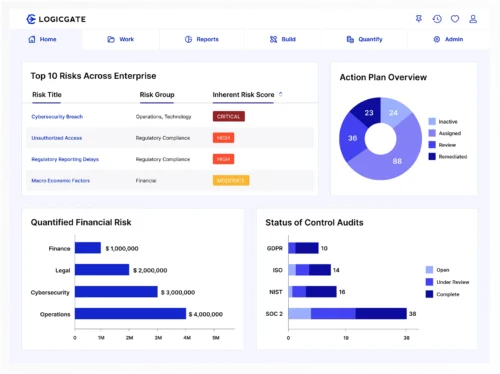

| LogicGate | N/A | 4.6 | Low-code; Workflows dinâmicos. | Flexible; quick to adapt. | Limited analytics; requires modeling. |

| Riskonnect GRC | N/A | N/A | Management of operational and insurance risks; Pre-configured regulatory reports. | Financial focus; Good for incident management | Dated UX; long configuration. |

| Workiva | N/A | 4.5 | Reporting colaborativo; auto‑updating. | Real-time collaboration; Financial Reporting | Focus on the financial sector; high price. |

| RSA Archer | 3.9 | 3.6 | Settable; ECB; Report library. | Extreme flexibility; active community. | Complex; requires consulting. |

1. SoftExpert Suite

Capterra ratings: 4.6 / 5. The reviews highlight the process of automation, API integrations, intuitive interface, customer support, and flexibility in GRC configuration. In addition, they indicate that there is an initial complexity of use and that graphic elements could have a more modern design.

G2 ratings: 4.7/5. Users highlight the connection between GRC and the other SoftExpert Suite modules; cross-team collaboration, customer support, and data analytics. On the other hand, they also point to a certain complexity of setup and a steeper learning curve.

Key features:

- Solution that goes beyond GRC, with complementary and scalable modules.

- The risk module is integrated with automation of critical processes and AI.

- Automated compliance with audit trails.

- Configurable dashboards.

Pros:

- Risk visibility is linked to operational processes.

- High level of customization of workflows.

- Support with fast SLA.

Cons:

- The initial learning curve in the advanced risk modules.

- Out-of-the-box integrations are still expanding.

Description:

SoftExpert GRC has an excellent convergence between usability and functional depth, serving medium and large corporations. Its differential is in the localized service and configuration flexibility, although it requires more structured onboarding in companies without previous maturity in GRC.

The solution is designed to help organizations align their business strategies with effective risk management and compliance practices. You can:

- evaluate processes and assets using Business Impact Analysis,

- create business continuity plans,

- manage AI-backed risks and opportunities in a fully configurable tool,

- monitor critical risks easily through heatmaps,

- portals and interactive graphics,

- conduct risk-based audits.

2. Vanta

Capterra ratings: 4.5 / 5. The reviews show the simplicity of the platform’s implementation. Users highlight the interface and customer support. On the other hand, user reviews point out limitations in customization flexibility and that costs can scale quickly as the number of integrations increases or the need for additional features.

G2 ratings: 4.6/5. Vanta’s features in G2 are praised for the automation of cloud security controls, continuous monitoring that automatically identifies compliance gaps, and the intuitiveness of dashboards. On the other hand, users point out bugs, a lack of customization and integration with other software.

Key features:

- Security control automation.

- Real-time monitoring of infrastructure compliance.

- Guided remediation of findings.

- Native integration with cloud computing solutions.

Pros:

- Quick to implement and get the first certification.

- 24/7 documentation and support.

Cons:

- Strong focus on IT; It has fewer pure corporate governance features.

- Advanced customizations are expensive and insufficient for some use cases.

Description:

Vanta stands out for the speed of setup and automation of cloud security controls. It’s ideal for startups and IT teams that need to prove compliance quickly, but it may fall short in scenarios that require governance of broader, more complex business processes.

3. Diligent (formerly known as Galvanize)

Capterra ratings: 4.5 / 5. The assessments highlight the analytical and automation capabilities, especially for data normalization, fraud detection, and continuous monitoring of controls. On the other hand, the main negative points involve the learning curve in the more advanced modules, the complexity of setting up in large projects, and the limitations in customizing reports and templates.

G2 ratings: 4.3/5. Users praise its ability to centralize GRC activities in a single portal, making it easy to view risk, audits, and compliance with dashboards. However, they also point to a steep learning curve, a complex setup in large environments, and limitations in the usability of some modules.

Key features:

- Data intelligence for continuous auditing.

- Customizable quizzes and control tests.

- Analytics-based risk reporting.

Pros:

- Strong in continuous auditing and analytics.

- Good support to internal audit teams.

Cons:

- The interface is considered unintuitive by some users.

- High licensing costs.

Description:

Diligent (formerly Galvanize) is robust in continuous auditing and analytical reporting. It is suitable for internal audit and technical compliance areas, although its total cost and UX may be barriers for smaller organizations. It features pre-configured plug-and-play solutions, integrations, workflows, and dedicated support.

4. MetricStream

G2 ratings: 3.9/5. Users value the broad functional coverage — with modules for internal audit, business continuity, ERM, compliance, and IT risk — and highlight the robustness of the analytics and reporting capabilities. However, recurring criticisms mention the complexity of the interface and initial setup, as well as slowness in high-volume scenarios and a steep learning curve.

G2 Reviews: N/A

Key features:

- Complete GRC suite with independent modules.

- Business continuity management.

- Supplier management and outsourced risks.

Pros:

- Highly scalable for large corporations.

- Specialized modules for various frameworks.

Cons:

- Long and complex implementation.

- Very high cost of implementation.

Description:

MetricStream is a scalable and modular solution best suited to large organizations with extensive regulatory requirements. However, its time-to-value is usually longer and more costly. It integrates end-to-end governance, risk, and compliance processes. The platform also offers an integration marketplace and a low-code application studio.

5. LogicGate

Capterra Reviews: N/A.

G2 ratings: 4.6/5. The reviews highlight the ease of use and intuitiveness of the interface, which allows you to create and adjust GRC workflows without IT support. Among the negative aspects are the functionalities still in development, limitations in consolidated reports, and missing features that prevent more complex GRC scenarios.

Key features:

- Low-code platform for creating GRC processes.

- Dynamic workflows and customizable forms.

- Built-in reports and dashboards.

Pros:

- Agility to create and adapt processes.

- Modern and intuitive platform.

Cons:

- Analytics capabilities are still evolving.

- Requires knowledge of process modeling.

Description:

LogicGate’s tool stands out for its low-code flexibility, allowing GRC teams to develop and adjust flows quickly. Recommended for companies looking for agile process prototyping. The solution offers process automation, dashboards and reports, integration via API, and Artificial Intelligence (AI) tools.

6. Riskonnect GRC

Capterra Reviews: N/A

G2 Reviews: N/A

Key features:

- Integrated management of operational and insurance risks.

- Incidents and complaints module.

- Pre-configured regulatory reports.

Pros:

- Strong in the financial and insurance sector.

- Good support for incident workflows.

Cons:

- Interface considered dated.

- Relatively long setup curve.

Description:

Riskonnect GRC is focused on operational and insurance risks. Therefore, it is widely used in banks and insurance companies. It has a good set of regulatory reports, but it lacks a more modern UX. In addition, the tool offers integrations via API and “out-of-the-box” connectors for internal and external systems.

7. Workiva

Capterra Reviews: N/A

G2 ratings: 4.5/5. The reviews highlight the ease of use and team collaboration. Functionalities and operational efficiency are also strengths, especially in the context of financial reporting, ESG and internal controls. On the other hand, there are recurring criticisms of limited functionality, slow loading of dashboards, and the learning curve.

Key features:

- Collaborative office in the cloud for reporting and disclosures.

- Auto-updating.

- Management of internal controls and SOX.

Pros:

- Real-time collaborative experience.

- Excellent financial reporting and SEC filings.

Cons:

- It can go outside the scope of pure GRC in companies without a financial focus.

- Price above the market average.

Description:

Workiva’s GRC software is a more suitable option for collaborative financial reporting and SOX control. While it doesn’t cover all aspects of GRC, it excels in disclosures and regulatory reporting. The tool also has automation of controls and reports, and collaboration features that simplify workflows between teams.

8. RSA Archer

Capterra Ratings: 3.9 / 5. The evaluations highlight the main strengths the wide flexibility of configuration, allowing organizations to model GRC processes according to their specific needs. Users also highlight the centralized visibility in customizable dashboards. Among aspects that are less than ideal are the steep learning curve, the time and cost of implementation, and the user interface.

G2 ratings: 3.6/5. Most users highlight the robust dashboards and extensive configuration flexibility. However, the negative points are due to the complexity of the interface and the steep learning curve, especially in the initial configuration and advanced customizations.

Key features:

- Highly configurable platform for multiple GRC use cases.

- Enterprise risk management and business continuity.

- Extensive library of reports and dashboards.

Pros:

- Flexibility and very wide functional coverage.

- Active community and many add-ons.

Cons:

- The interface is considered complex and unintuitive.

- Implementations may require specialized consulting.

Description:

RSA Archer IRM is a highly configurable solution on the list and is suitable for companies that want to tailor the tool to their processes. However, this flexibility comes with the complexity of use and the cost of implementation. In addition, it monitors regulatory changes, creates requirements catalogs, captures incidents, and automatically adjusts controls.

Conclusion

The value of GRC software becomes more evident as the market offers a growing number of such solutions. In other words, if you want to improve your risk management and compliance, strengthening your company’s governance, there is no shortage of options.

However, this diversity does not guarantee that you will have a GRC solution that meets your requirements. Therefore, it is necessary to go further and seek a complete solution that is truly recognized in the market.

Based on the comparison you checked and the application of a clear checklist of criteria, it is easy to see that your organization will be better equipped by relying on SoftExpert GRC.

Its automation and real-time monitoring capabilities ensure that companies operate with greater agility, traceability while maintaining high levels of security and regulatory adherence.

In addition, SoftExpert’s platform has Artificial Intelligence capabilities and flexibility that make it possible to efficiently shape your risk control and prevention processes. With these features, the solution fully serves organizations that require robust solutions without sacrificing operational performance.

By combining advanced cloud-based technology, a user-friendly interface and adaptability to different demands — including in highly regulated industries — SoftExpert Suite is the ideal option for those who want not only to automate, but also to optimize and revolutionize their GRC management.

Looking for more efficiency and compliance in your operations? Our experts can help identify the best strategies for your company with SoftExpert solutions. Contact us today!