Discussions about ESG (Environmental, Social and Governance) practices no longer remain in the field of intentions. They have become strategic variables that impact risk, market value, and financing capacity of companies.

For executives of companies in regulated sectors, where health, environmental, and compliance requirements have direct consequences on operations and reputation, the question is no longer “should I look at ESG?” and has become “how to integrate ESG into the core business in a measurable and defensible way?”.

Keep reading and see how to transform ESG practices into a compliance requirement and, at the same time, a source of competitive advantage when treated with appropriate governance, measurement, and technology.

What are ESG practices?

In general, ESG practices describe a set of extra-financial factors that affect the company’s ability to create value in the short, medium, and long term, specifically considering environmental, social, and governance aspects.

In this context, investors, regulators, and customers increasingly expect sustainability to be part of the strategic plan — and that is why it is vital to turn these practices into concrete actions.

In practice, some of these actions that consumers have come to expect include:

- Environmental (E): reduction of GHG emissions (the so-called scope 1/2/3), control of water consumption, waste treatment, and responsible use of inputs.

- Social(S): protection of safety and health at work, support for diversity measures, actions with a positive impact on communities, and conduct in the value chain.

- Governance (G): diversity and equity in the composition of the board, having anti-corruption controls, compliance and risk management.

To help adopt some of these practices, you can adopt global frameworks and standards, such as the Global Reporting Initiative (GRI), be part of the GHG Protocol, and follow the IFRS S1/S2 set of standards. These frameworks and protocols offer consolidated bases for defining what to disclose and how to connect sustainability to financial information.

Why does ESG matter in regulated markets?

Recent research shows that a significant portion of investors understand that sustainability goals should be incorporated into corporate strategy, even when they require short-term sacrifices. This is because they affect the risk assessment and future performance of the company.

On the operational side, ESG initiatives tend to produce tangible gains in efficiency, such as:

- reduction of energy consumption;

- optimization of the production chain;

- less waste of time, investment, and inputs.

When measured, these initiatives are no longer reputational costs but become levers for results.

While it changes the operation of companies, this movement changes the relationship between management and capital. More robust disclosures make the company less exposed to surprises, while the lack of reliable evidence increases the cost of capital and reputational risk.

When integrated into the business model, ESG actions can unlock five types of value creation:

- protection against risk;

- cost reduction;

- incremental revenue generation;

- improvement of human capital;

- operational efficiency gains.

To have these positive effects, however, it is necessary to have a rigorous design, clear goals, and data governance.

Standards and frameworks: where to start to speak the language of the market

An ESG strategy that is taken seriously by investors and regulators is supported by recognized international standards. The GHG Protocol, for example, offers the technical language for accounting for emissions (in scopes 1, 2, and 3), a fundamental standard for any carbon inventory that intends to be accepted by third parties.

At the same time, the GRI standards continue to be a reference for reporting economic, environmental, and social impacts transparently. The International Sustainability Standards Board (ISSB) represents the new layer of requirements focused on information that has financial relevance for users of the statements.

A necessary condition for building verifiable and defensible narratives is to integrate these references when choosing the scope and depth of each disclosure based on the materiality of the business.

Using these recognized frameworks as a reference to map materiality and ensure comparability, you can adopt some KPIs such as:

Environmental

- Total GHG emissions — Scope 1, 2, and Scope 3 (tCO₂e) estimates;

- Energy consumption per unit of production (MWh/unit);

- Water consumption and water intensity (m³/unit);

- Percentage of waste sent for disposal with certified treatment.

Social

- Safety Incident Rate (LTIFR) and Days Lost by Accident;

- Turnover rate and retention rate by salary range/gender/ethnicity;

- Percentage of suppliers audited for human rights.

- Percentage of women in leadership.

Governance

- Percentage of the Board with independence and diversity;

- Number of cases of regulatory non-compliance/year;

- Average time to remediation of critical controls.

- Number of reports received through confidential channels.

The fear of the “empty number” and how to avoid it

The main pitfall I see in ESG projects is just treating these metrics as a piece of communication instead of as a management input. KPIs without an owner, without a validation process, or without a connection to concrete decisions, become only empty statements; worse than that, they can amount to mere greenwashing.

And to prevent this from happening, it is essential to perform serious measurements of such metrics. This starts with having a materiality map that connects risks and opportunities to the company’s financial model. From then on, each indicator needs to have an independent responsible, data source, and validation routine.

As an example, we can look at emissions. Applying the GHG Protocol means distinguishing Direct Emissions (Scope 1), Indirect Emissions by energy (Scope 2), and chain emissions (Scope 3); then, it must be recognized that Scope 3 only becomes useful information when critical suppliers get on the radar and provide reliable data.

In practice, this requires three integrated fronts:

- governance (who decides and approves);

- processes (how data is generated and verified);

- technology (where data is consolidated, reconciled, and audited).

Without this triad, the result is usually a beautiful and indecisive report — and, thus, without real impact on the operation.

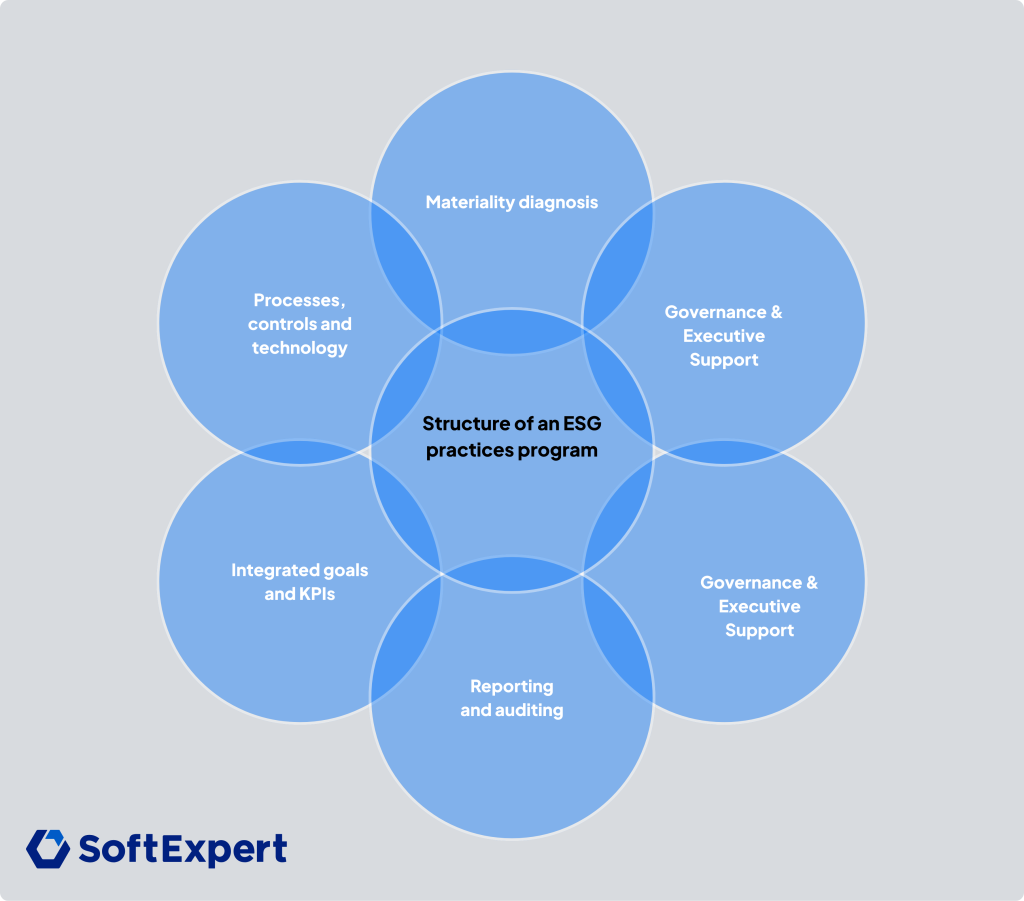

How to structure an ESG practice program?

To make ESG governable and generate returns, I suggest adopting a pragmatic roadmap that combines diagnosis, governance, goals, and technology. First, perform a materiality diagnosis that identifies the value and compliance priorities for the company.

In parallel, formalize executive support and create the Center of Excellence responsible for methodologies and data. With materiality defined, translate priorities into measurable goals (science-based targets where applicable) and break them down into owner-driven initiatives and actionable metrics.

Then, choose the technology framework that will support the data (for example, using a GRC solution, an emissions inventory platform, and a BI tool). This way, you guarantee and optimize the validation and external audit processes of key indicators.

Finally, plan annual review cycles that incorporate lessons learned and adapt goals to the regulatory and market context, thus generating continuous improvement.

See below a step-by-step structure that you can follow in your company:

- Materiality diagnostics: Identify risks and opportunities that impact value and compliance; prioritize likelihood and impact.

- Governance & executive support: Establish an executive committee and project sponsor (CFO or CEO, for example), then link ESG goals to the company’s strategic plan.

- Integrated goals and KPIs: define science-based goals when applicable and indicators linked to short/medium-term incentives.

- Processes, controls, and technology: Standardize data collection, internal controls, and integration with ERPs and management systems (such as GRC and ESG).

- Reporting and auditing: align reports with GRI and/or ISSB standards and perform audits to mitigate risks of questioning by investors and/or regulatory entities.

- Continuous improvement: Conduct cycles of annual review, updating goals, and incorporating lessons learned.

Another good practice that creates results is to have an ESG Center of Excellence integrated with the Risk & Compliance areas. This accelerates standardization, consolidates data, and reduces duplication of initiatives.

Finally, remember that this roadmap is not linear: diagnosis, governance, and technology must go hand in hand so as not to turn the project into a series of disconnected initiatives.

ESG tools your company needs to adopt

Technology is not a luxury. It is the minimum infrastructure for metrics to be auditable. Therefore, having specialized GRC and emissions accounting platforms allows you to consolidate evidence, automate calculations (including up-to-date emission factors), and generate audit trails that support transparency.

Market solutions that work on both integrated GRC management and environmental inventory help reduce information silos and speed up the response to inspections and due diligence.

It was through technology that LIASA, the largest manufacturer of silicon metal in South America and one of the global leaders in the sector, achieved significant results using SoftExpert’s solution for ESG, such as:

- Automation and standardization of supplier management;

- Reduction of errors and improvement in ESG risk management;

- Generation of detailed reports and analysis;

- Compliance with GRI requirements.

Therefore, when evaluating suppliers, prioritize integration capacity with tools that your company already uses (such as ERP, SLM, BI), data sources, and external audit support. Without this, the company risks relying on manual reconcilers that increase costs and the likelihood of human error.

Some types of essential tools to have good ESG practices in your operation are:

- ESG / Environmental Accounting platforms for emissions inventory and GHG calculations;

- GRC / Compliance solutions to integrate risks and controls into the decision-making flow;

- Data management and BI platforms for data consolidation, validation, and distribution;

- Reporting platforms that support GRI/ISSB, and APIs to integrate data into the publishing and auditing system.

Key risks and how to mitigate them

There are recurring risks that deserve executive attention in ESG management. The first and most reputational is greenwashing: making sustainability claims without robust evidence can result in sanctions, loss of trust, and litigation.

This is avoided through transparent goals, public methodology, and external auditing of critical data. Another risk is the quality of the data. Without an automated pipeline with owners, checks, and reconcilers, indicators become inconsistent across reports; This is a fatal problem for investors and regulators.

Finally, the supply chain poses a risk of contamination. The inappropriate practices of third parties can reverse the entire corporate effort. Mitigation involves supplier management through contracts with ESG clauses and risk-based due diligence and engagement programs with strategic suppliers.

In the face of these challenges, it is essential to have the right tools and partners. At SoftExpert, we provide solutions that centralize processes, documents, and risks in a single management platform.

But in addition to tools, it is vital to have the knowledge and support to define these ESG processes, controls, and good practices — and for that you can count on Manent Consulting.

Conclusion

ESG practices are a strategic imperative for regulated companies: they reduce risks, improve operational efficiency, and are increasingly a condition for access to investment capital.

Therefore, looking at ESG cannot be treated only as a trend of the future or a mere regulatory obligation; Companies that adopt this area as a fundamental part of their business captivate more customers, gain space in the market, and reinforce compliance.

For this, executives and leaders need to have an accurate diagnosis of the current ESG scenario of their companies; align strategic goals with real impact (and those responsible for them); and, above all, invest in technology and in the support of entities that are specialized references in ESG.

ESG Practices FAQ

ESG practices are corporate actions and policies focused on Environmental, Social, and Governance factors that reduce risks and create sustainable value for the company and stakeholders.

It depends on the sector: Hospital and chemical waste management (RDCs, traceability) (health), working conditions in the agricultural chain (food), emissions and energy efficiency in production (manufacturing). Sectoral materiality analysis is recommended.

With clear KPIs (e.g., Scope 1–3 emissions, safety incident rate, board composition index) aligned with frameworks such as GRI and ISSB.

Data management systems, GRC platforms, and reporting software automate the collection, validation, and publication of ESG data, reducing error and cost.

Assign owners to indicators, define data sources and validation routines, integrate governance, processes, and technology, and submit critical data to external audit before communicating publicly.

Prioritize chain categories with greater materiality, engage critical suppliers for data, use robust estimates when necessary, and document methodologies. Scope 3 is only effective when there is governance and supplier data.

Greenwashing, poor data quality, and supply chain failures are the main risks. Mitigation: public methodologies, external audit, data pipeline with owners and contractual clauses + due diligence for suppliers.

Perform materiality diagnosis, formalize sponsorship and Center of Excellence, translate priorities into measurable goals, choose a technological stack that supports auditable data, and establish annual cycles of review and continuous improvement.